WEEKLY MARKET UPDATE

AZ Real Estate Market Update August 2024

September 04, 2024

CWU #131 – Three Things I Learned from 2022

January 06, 2023

Capstone Weekly Update #122 – The State of Leasing in the Phoenix Metro

November 18, 2022

Capstone Weekly Update #114

September 29, 2022

Weekly Market Update 9/3/21

September 07, 2021

Weekly Market Update 8/28/21

September 07, 2021

Weekly Market Update 8/23/21

September 07, 2021

Weekly Market Update 8/13/2021

September 07, 2021

Weekly Market Update 8/6/21

August 06, 2021

Weekly Market Update 7/23/2021

July 23, 2021

Weekly Market Update 7/16/21

July 16, 2021

Weekly Market Update 7/3/2021

July 03, 2021

Weekly Market Update 06/25/2021

June 25, 2021

Weekly Market Update 6/18/21

June 18, 2021

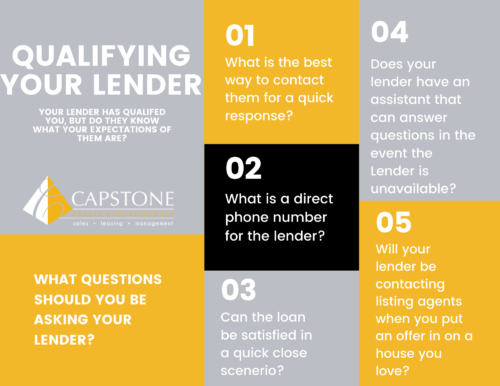

How do you know you are working with the right lender?

June 16, 2021

Weekly Market Update 4/30/2021

May 05, 2021

Weekly Market Update 4/23/2021

May 05, 2021

Weekly Market Update 4/16/2021

May 05, 2021

Weekly Market Update 4/9/2021

May 05, 2021

Weekly Market Update 4/2/2021

May 05, 2021

Weekly Market Update 3-26-2021

May 05, 2021

Weekly Market Update 3/19/2021

May 05, 2021

Weekly Market Update 03/12/2021

May 05, 2021

Weekly Market Update 2/19/2021

February 19, 2021

Weekly Market Update 2/12/2021

February 12, 2021

Weekly Market Update 2/5/21

February 05, 2021

Weekly Market Update 1/15/2021

January 15, 2021

Weekly Market Update 1/8/21

January 11, 2021

Weekly Market Update 12/18/2020

December 21, 2020

Weekly Market Update 12/11/2020

December 15, 2020

Weekly Market Update

December 07, 2020

Weekly Market Update 11/20/20

November 23, 2020

Weekly Market Update 11/13/20

November 16, 2020

Weekly Market Update 11/6/20

November 10, 2020

Phoenix Real Estate Market Update 10/30/20

November 02, 2020

Weekly Real Estate Market Update 10/23/20

October 26, 2020

Capstone Raw – Know Your Insurance Policy

October 19, 2020

Weekly Market Update 10/16/2020

October 19, 2020

Weekly Market Update 10/9/20

October 12, 2020

Weekly Market Update 10/3/20

October 05, 2020

Weekly Market Update 9/25/2020

September 28, 2020

Weekly Market Update 9-18-2020

September 22, 2020

Weekly Market Update 9/11/2020

September 15, 2020

Weekly Market Update 9/5/2020

September 08, 2020

Talking To A Professional Painter – Home Buying, Selling, and Renting Tips

September 01, 2020

Market Update 8/28/2020

September 01, 2020

Market Update 8/21/2020

August 24, 2020

What To Look For When Inspecting a Roof

August 20, 2020

The Importance of Home Warranties

August 20, 2020

Weekly Market Update 8/14/2020

August 17, 2020

How Your Lender Can Help You Get Your Offer Accepted

August 14, 2020

Weekly Market Update 8/7/20

August 07, 2020

Market Update 7/31/20

July 31, 2020

Market Update 7/24/20

July 24, 2020

Weekly Market Update 7/17/20

July 17, 2020

Weekly Market Update 7/3/2020

July 03, 2020

Weekly Market Update 6/26/20

June 26, 2020

Short Term VS Long Term Rentals

April 21, 2020

BLOG

The 3-Number Phoenix Sell-or-Rent Test That Matters More Than Your Home’s Zestimate

published on February 27, 2026

For years, homeowners have been told to focus on one number: “How much is my house worth?” But that number alone won’t tell you whether you should sell or rent. …

Real Estate Fraud Is Rising in Phoenix: What Property Owners Need to Know

published on February 06, 2026

As the economy tightens, one trend we consistently see return is real estate fraud. Across the Phoenix metro area, scams involving fake rental listings, unauthorized property access, and attempts to …

2026 Phoenix Real Estate Market Update: How Capstone Built Stability Through a Changing Market

published on January 23, 2026

As we officially close the door on 2025 and step into 2026, it’s a great time to pause, reflect, and share what’s happening behind the scenes at Capstone Realty. Last …

Phoenix Real Estate Market Update 2026: Buyer Momentum, Market Shifts & What Investors Need to Know

published on January 16, 2026

The Phoenix real estate market is officially shifting gears as we move into 2026 — and the early indicators are lining up exactly how we expected. This week, I’m checking …

Phoenix Real Estate Market Recap: What 2025 Taught Us and What It Means for 2026

published on January 09, 2026

As we head into 2026, it’s a good time to step back and look at what really defined the Phoenix real estate market in 2025 — what worked, what changed, …

Phoenix Housing Market Update: Appreciation Trends, Rental Shifts, and What to Expect Moving Into 2026

published on December 05, 2025

As 2025 comes to a close, the Phoenix real estate market continues to evolve in ways even seasoned investors didn’t see coming. This year alone, conversations with owners and buyers …

Strategic Price Drops in Real Estate: How to Avoid Leaving Money on the Table

published on August 21, 2025

As the Phoenix housing market continues to shift, knowing when to drop the price—and when to hold firm—has become one of the most important strategies for property owners. Whether you’re …

Phoenix Rental Market 2025 Outlook: Investor Trends & Opportunities

published on August 13, 2025

The Phoenix real estate market is entering a pivotal moment for property investors and rental property owners. With interest rates at their lowest in 10 months, fewer active listings, and …

How One 5-Star Review Proves Capstone Excels at Property Management

published on July 25, 2025

At Capstone Realty Professionals, we take pride in delivering more than just service—we create meaningful, responsive relationships with tenants and property owners alike. That’s why when a tenant leaves an …

How Semiconductors Are Shaping Phoenix Real Estate

published on May 21, 2025

The Phoenix metro area is rapidly evolving — not just as a housing hotspot, but as a global industrial hub. I recently had the opportunity to sit in on a …